The End of the Year Brings Multiple Deals

There’s always this inherent stress that comes from the end of the year. The goals we set in January suddenly come back to rear their ugly heads. We try to generate any last bit of revenue, hoping to finish the quarter stronger.

And it appears that investment bankers and lawyers rush to ruin their holiday season by getting deals done before the new year. This one actually makes sense to me since bonuses are likely paid based on revenue earned in a calendar year, so earning it on January 1st means you’re waiting a full year.

I digress…

The past couple of weeks have been filled with deal news of all shapes and sizes. On Friday, I wrote about Axios acquiring The Charlotte Agenda for $5 million. But there has been a flurry of activity beyond that.

Industry Dive

The first is the recent acquisition of CFO.com by the Industry Dive team. According to Business Insider:

Terms of the CFO.com were not disclosed. A person familiar with the matter said CFO.com would generate about $5 million in revenue this year. Around 10 editorial and operations staffers will join Industry Dive, which plans to hire more journalists for the CFO team. Industry Dive currently employs 240 full-time staff.

CFO started in 1985 as a monthly print magazine. The Economist Group acquired the company in 1985 and sold it to private equity firm Seguin Partners in 2010. The title was then acquired in 2016 by events company Argyle Executive forum, which will retain CFO’s in-person events business.

Industry Dive is getting access to all the content, the database of finance professionals, and a sweet three-letter domain name. I’m not even going to try and assume how much the team paid, but this story also has some other data points about Industry Dive that are worth looking at.

The 8-year-old publisher, with more than 20 B2B titles including Retail Dive and BioPharma Dive, says it is on track to grow revenue 30% this year, to $60 million. The company confirmed it is also profitable – with 30% margins, as Digiday previously reported – positioning it to make acquisitions.

The acquisition should also help Industry Dive deepen relationships with its enterprise advertisers. Griffey said the company now has more than 150 clients spending around six or seven figures on advertising with Industry Dive annually, with the top 10 clients averaging around $1.5 million in spend each. Last year, only about two or three clients were spending to that level, Griffey added. Already, forward-bookings for next year are up 40% versus last, he said.

That growth is incredible. According to this Folio story published in September 2019:

With revenues have more than quadrupled since 2015 to $22 million as of last year, the company hired eight additional editors and reporters a month ago when it launched its 19th vertical, CFO Dive, bringing the total newsroom headcount to 72.

Growing from $22 million to $60 million from 2018 to 2020 is tremendous growth. My guess is that the NewsCred deal brought with it many clients, which has helped increase revenue. However, despite that, is it any wonder the team is making acquisitions? 30% of $60 million is a lot of money to buy niche, very focused publications.

Penny Hoarder

If we change pace, it was announced on Monday that Penny Hoarder had been acquired by a division of Sykes for $102.5 million. This was based on $50 million in trailing twelve-month revenue.

On one hand, this is obviously exciting for the team. But a roughly 2x revenue acquisition seemed a bit low to me. A couple of theories why…

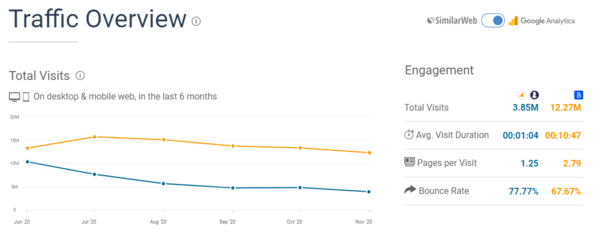

The first is that traffic has gone off an absolute cliff. If we compare Bankrate to The Penny Hoarder:

Looking at June, Bankrate had 13.2m visits while The Penny Hoarder had 10.3m. However, if we fast forward to November, Bankrate had dropped to 12.3m visits while The Penny Hoarder had dropped to 3.85m.

Another thing to consider is that revenue has effectively plateaued. Looking at this tweet:

Growing $13 million in revenue from 2017 to 2020 is obviously indicative of a business that’s slowing, especially when it grew by such large numbers in its earlier years.

This deal likely boils down to lead gen functionality. More specifically, it has a business targeted to the insurance industry with a focus on licensed sales, performance-based customer acquisition, etc.

The bigger question I have is whether this means Sykes starts to make more acquisitions in the media space. If it views these properties as lower-cost avenues for driving leads, could it attempt to deploy a similar strategy to Red Ventures, which owns Bankrate, The Points Guy and a variety of other publications in various niches?

This deal is expected to be closed by end of year.

Group Nine Media

And then the final one, which is one we’ve been anticipating, is the recently announced Group Nine Acquisition Corp. Yes, ladies and gentlemen… Group Nine is trying to go public. The SPAC is looking to raise $230 million. According to the S-1:

We believe the combination of Group Nine Media and another target business in the digital media and adjacent industries, including the social media, e-commerce, events, and digital publishing and marketing sectors under the Group Nine Media umbrella will allow the resulting combined company to leverage Group Nine Media’s existing licenses, experienced management team and geographic footprint and offer significant synergy and long-term value creation opportunities for our investors and serve as a platform for further growth.

That is a lot of words to say something pretty straightforward… Group Nine is looking to raise a bunch of money so that it can acquire itself; however, at the same time it is acquiring itself, it will also acquire another company. However, as they stipulate on page 87:

We will not, however, complete an initial business combination with only Group Nine Media.

I have a lot of thoughts about this deal and I’ve been thinking about it ever since it was rumored to be happening last week by Ben Mullin over at The Wall Street Journal.

First things first… Why do this? That answer is actually pretty straight forward. The market is absolutely insane. Like… really freaking insane. What’s better than getting insane returns on liquid assets, am I right?

But with there being so much excitement about the public markets, this is Group Nine’s chance to clear the cap table, help investors generate a return on their long-term investment, and have a tool to start acquiring other assets.

Famed Fidelity investor, Peter Lynch, wrote in one of his books that you should buy what you know. The thesis here is that retail investors will know Group Nine Media properties and, therefore, buy what they know. Cue the frothiness.

Second, how much will Group Nine Media actually be worth? This is a little harder to ascertain, but let’s try to piece it together. According to this TechCrunch article:

According to law firm Vinson & Elkins, there’s no maximum size of a target company — only a minimum size (roughly 80% of the funds in the SPAC trust).

In fact, it’s typical for a SPAC to combine with a company that’s two to four times its IPO proceeds in order to reduce the dilutive impact of the founder shares and warrants.

In the case of Hartz’s and Steckenrider’s SPAC (it’s called “one”), they are looking to find a company “that’s approximately four to six times the size of our vehicle of $200 million,” says Hartz, “so that puts us around in the billion dollar range.”

That 2-4x number is worth remembering. Now, if we look at Group Nine, we know that it acquired POPSUGAR for over $300 million in stock for more than 30% ownership of the combined company. According to The Wall Street Journal, the combined company in October 2019 was $1 billion.

The Group Nine SPAC is looking to raise $230 million. If we assume a 2-4x price target, then we know the SPAC has fire power upwards of $920 million. Obviously it can stretch and try for 5x, but let’s keep it simple…

But the Group Nine Acquisition Corp did stipulate that it will not just acquire Group Nine Media, but rather, that it would do so in conjunction with another acquisition. The question I have is how much of this deal goes toward acquiring Group Nine Media? Let’s say 95%. That means $46 million will be allocated to acquire a small company and then the remaining $874m goes to Group Nine Media.

That’s $125m less than the $1 billion valuation that they said they were worth when POPSUGAR was first acquired, but they’re finally going public, so maybe a little cut is in order.

Let’s assume this deal does happen and I see no reason why it won’t with how many investors are looking for places to put their money. That means Group Nine Media will have an asset that is incredibly valuable: public stock in a frothy market. Now, it’ll be able to go out with a likely overvalued share and pick up companies for lower multiples, making the acquisitions immediately accretive.

To see that in action, assume that Group Nine’s newly public stock trades at 5x revenue after going public. It can turn around and acquire assets for 3x revenue, pay in stock, and still basically come out ahead.

Here are my questions… what comes next? If this works for Group Nine, you know BuzzFeed is right behind it. Will we start to see VCs getting excited about media all over again? Will the “scale over anything” debates rear their ugly heads because these zombies finally saw some light?

2021 is going to be incredibly interesting.