4-week vs. monthly subscription billing for publishers

Publishers can extract additional revenue from their subscription products simply by tying billing cycles to 4-week periods instead of calendar months. It’s a tactic currently being used by major news publishers including The New York Times, The Washington Post, Boston Globe, New York Magazine, Los Angeles Times and NY Daily News, among others, our research found.

The appeal of 4-week (or 28-day) billing cycles over monthly ones for publishers is simple: It enables them to charge subscribers 13 times per year instead of 12, which equates to 8% additional revenue on an annualized basis.

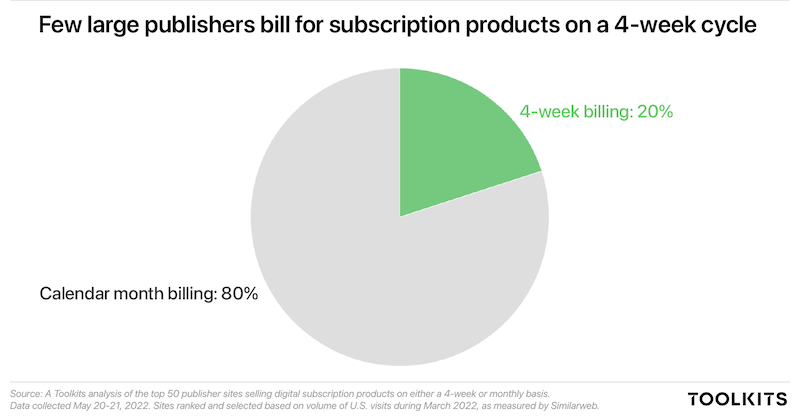

Toolkits examined the 50 largest U.S. publisher sites currently selling digital subscription products on either a 4-week or a monthly basis and found that 20% currently opt for 4-week billing periods and 80% use calendar months. Publishers using 4-week billing terms typically present them to new subscribers in the context of promotional offers, and alongside language that breaks down pricing on a per-week basis promising access for “$1 per week”, “$4 for 4 weeks” or similar.

Publisher considerations for 4-week billing

4-week (or 28-day) billing cycles can help generate additional revenue, but publishers should approach them cautiously. Four-week billing comes with potential risks and some key considerations, including:

Subscriber reception and trust

The biggest consideration for any publisher evaluating 4-week vs calendar month billing is the perception of current and prospective subscribers. While many people may not notice, understand or mind the implications of 4-week billing, some may feel misled by the practice or view it as a sly attempt by publishers to misrepresent pricing. This dynamic is particularly pronounced for publishers that use complicated pricing language in their marketing or rely on fine print to explain the intricacies of their billing terms at the point of sale.

From a logistical standpoint, four-week cycles also result in “floating” billing and transaction dates that change from one month to the next. This can leave subscribers confused as to when they’re being charged and why, and makes recurring payments more challenging to identify and parse on credit card statements

“Just realized my NYT subscription charges me every 4 weeks, which is NOT the equivalent of once a month, so they get a 13th payment out of me every year. Horrified at my naivité, but impressed by the revenue tactic… Can’t believe it took me so long to figure out! My due date kept changing and I just never questioned it,” one Twitter user noted, for example.

Attempting to switch from monthly to 4-week billing also risks irking existing subscribers and triggering churn if not handled delicately and transparently. Some publishers that have attempted to make the switch have encountered resistance from customers who viewed it as a sneaky price increase. Publishers considering a move from monthly to 4-week billing should consider doing so only for new subscribers, and leaving current subscribers with their existing payment cycles.

Transparency and clarity

In light of the perception issue outlined above, publishers that opt for 4-week billing should ensure their terms are presented to subscribers simply and transparently. The word “monthly” might be avoided entirely in order to minimize the potential for misunderstanding, and publishers should not rely on asterisks and fine print to explain the specifics of their pricing. Simple and direct language promising “4 weeks for $X” is advisable in order to avoid misrepresentation or subscriber confusion.

Transparency and clarity around all aspects of publishers’ subscription pricing and marketing strategies is becoming a requirement as the U.S. Federal Trade Commission, as well as regulatory bodies in Europe and other markets, begin to step up their enforcement of misleading practices regarding subscription pricing, terms and simple cancellation mechanisms.

Audience expectations and market precedent

Audience expectations have been trained by the billing practices of a handful of major subscription services, particularly those offering access to streaming video and audio. Services offered by Netflix, Spotify, Apple, Google – and even cable TV providers – are all oriented around monthly subscriptions and billing cycles, and audiences may currently assume this is the industry standard, even when 4-week terms are clearly communicated during purchase processes. At present, publishers appear to be the outlier in terms of offering content-based subscription products on 4-week cycles.

Managing floating billing dates

For publishers, floating billing dates can also make subscription revenue harder to track and understand if they’re used to recognizing, reporting and forecasting based on monthly billing. Adjustments may be required, and some publishers may wish to opt for monthly billing for the sake of simplicity and consistency.

Other observations from Toolkits’ research

During our analysis of 50 subscription publishers’ billing approaches, we made a few other notable observations:

Some pricing is essentially impossible to decipher: In some instances, the information presented by publishers prior to purchase was simply not enough for subscribers to ascertain how much they would actually be billed, and how often. For example, some publishers priced subscriptions at a weekly rate but said they bill monthly, and did not disclose how that monthly price would be calculated prior to purchase.

Calculations in marketing are often inaccurate: Some publishers opted to communicate pricing on a per-week basis but to bill on a monthly basis, meaning subscribers would actually pay less per week than what was being advertised. For example, prices might be positioned at $2.50 per week but billed at $9.99 per month, which actually equates to approximately $2.30 per week on an annualized basis.

Some sites in our sample were owned by the same companies, implying pricing approaches – and any revenue advantage gained from 4-week billing over monthly billing – might extend across their broader portfolio of brands. (For example, in the instance of news publishers that own multiple sites.)

Some publishers opt to bill weekly, which would net the same revenue on an annual basis as 4-week billing, but result in four times as many transactions over that period.

Research methodology: Toolkits analyzed the top 50 publisher sites selling digital subscription products on either a 4-week or monthly basis and collected data May 20-21, 2022. Sample sites were ranked and selected based on volume of U.S. visits during March 2022, as measured by Similarweb. Pricing and billing terms are based on publisher disclosures at the point of purchase, but we did not observe publishers’ actions at renewal. All offers analyzed were for “basic” digital plans or products, and were publicly available to new subscribers. Offers were examined using the incognito feature of Google’s Chrome browser, and a New York City IP address.